Our credentials

How we're different

Whether you are striving for an exit or capital event, we have the specialist expertise to ensure you find the right buyer or investor for you, and your business.

We help you turn a good deal into a great one. We know your buyers and their M&A strategies, and they know and trust us as the specialists who partner with market-leading, innovative companies.

Our team has an extensive track record of successful transactions. Our international network and deep sector knowledge ensure the right balance of strategic fit, competitive equity value, and optimal deal structure.

We’ve built and sold our own companies. We treat our clients’ businesses like our own.

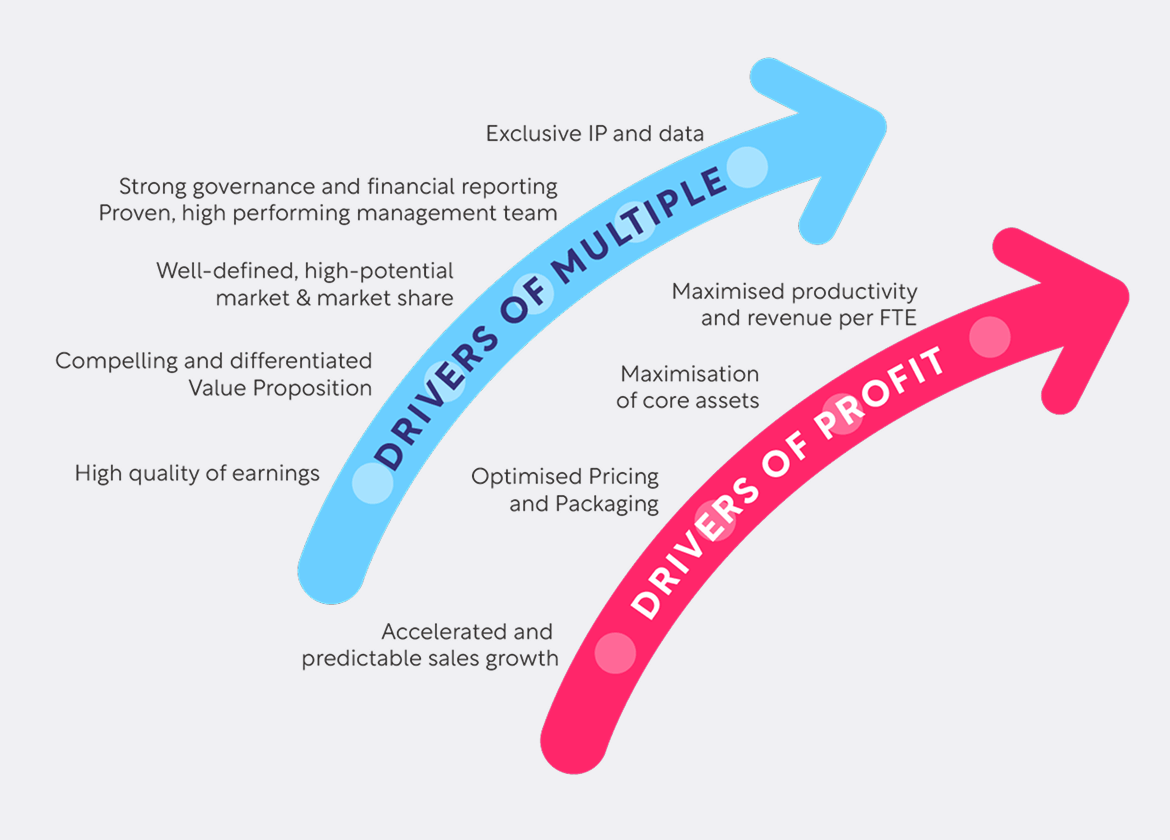

Making the value leap

Value is driven through a combination of multiple x profit. Getting the value drivers right across each of these, enables you to maximise the value of your business and make the value leap.

Making the value leap

Value is driven through a combination of multiple x profit. Getting the value drivers right across each of these, enables you to maximise the value of your business and make the value leap.

We know the market

We know the buyers

We know your business

We help you focus

Meet the team

Collingwood Corporate Finance Ltd. (FRN: 1039036) is an Appointed Representative of Odin Capital Management Ltd. (FRN: 478321) which is authorized and regulated by the Financial Conduct Authority in the United Kingdom.

Knowledge hub

Tools, webinars, events and announcements